Remuneration Policy

Senior Executive Remuneration Policy

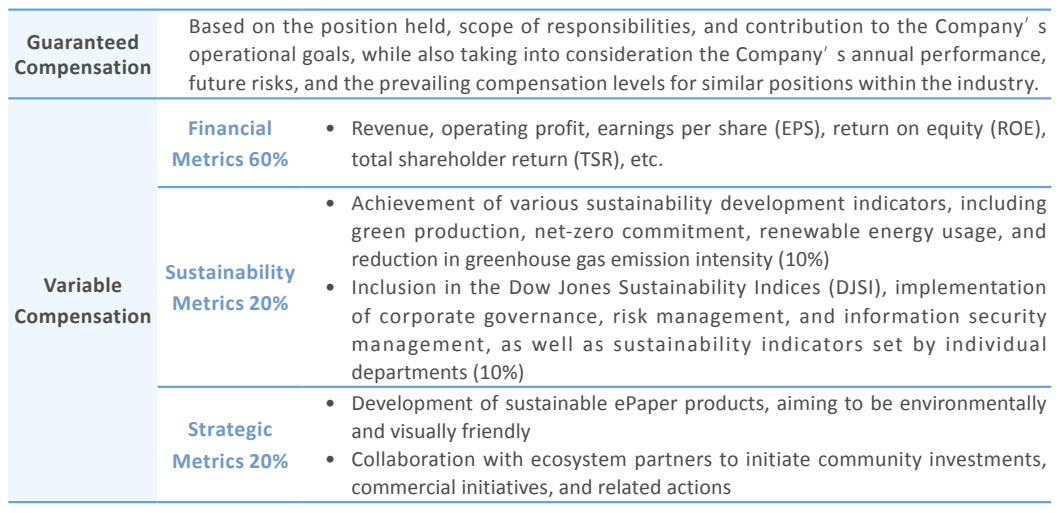

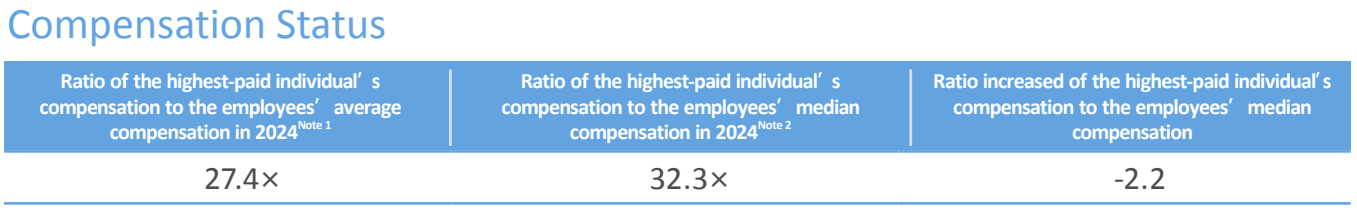

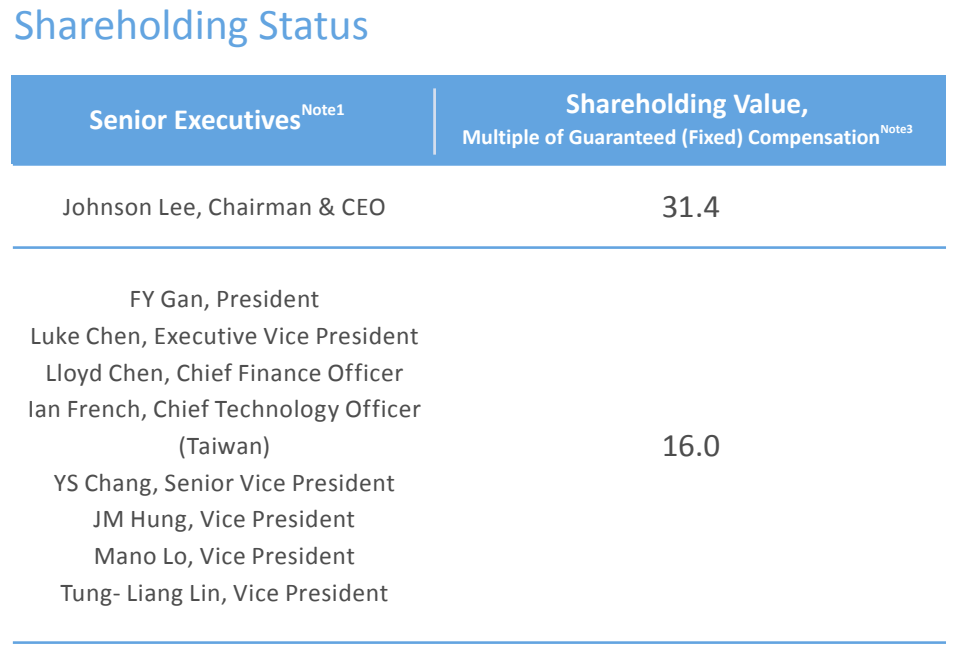

The compensation of E Ink’s Chairman, CEO, President, and Vice Presidents (senior executives) is directly correlated with the Company’s business performance. In addition to "Guaranteed Compensation", the Company adopts a "Variable Compensation" system—such as employee remuneration and long-and short-term retention bonuses—as the main components of executive compensation proposals. These are closely tied to performance indicators, including financial, sustainability, and strategic outcomes. The Compensation Committee evaluates these indicators along with other relevant managerial considerations and submits recommendations to the Board of Directors for approval. For 2024, more than 60% of the total compensation for senior executives is in the form of variable compensation. Notably, over 30% of this variable compensation is structured as deferred bonuses, to be disbursed over the next one to two years.