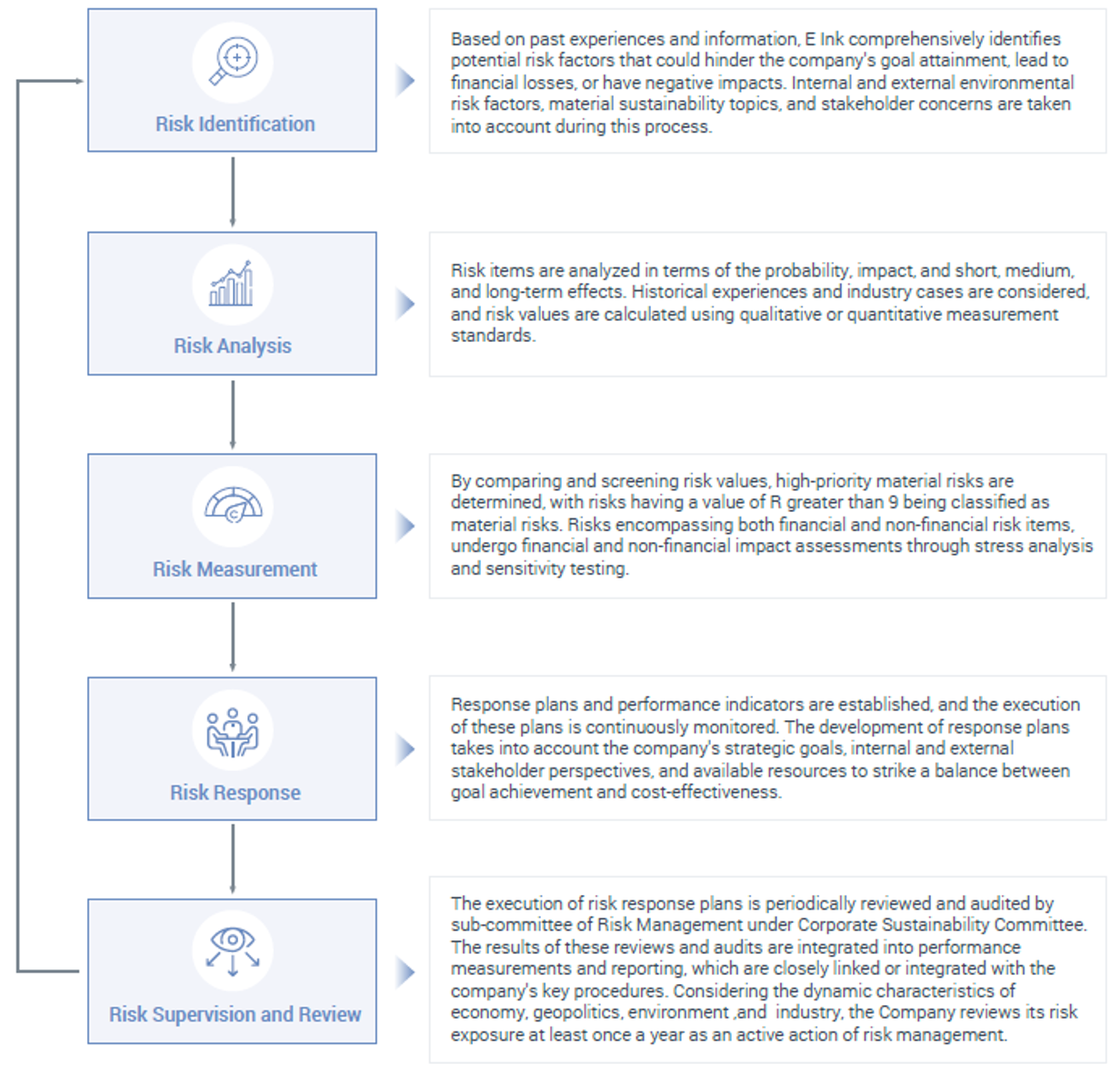

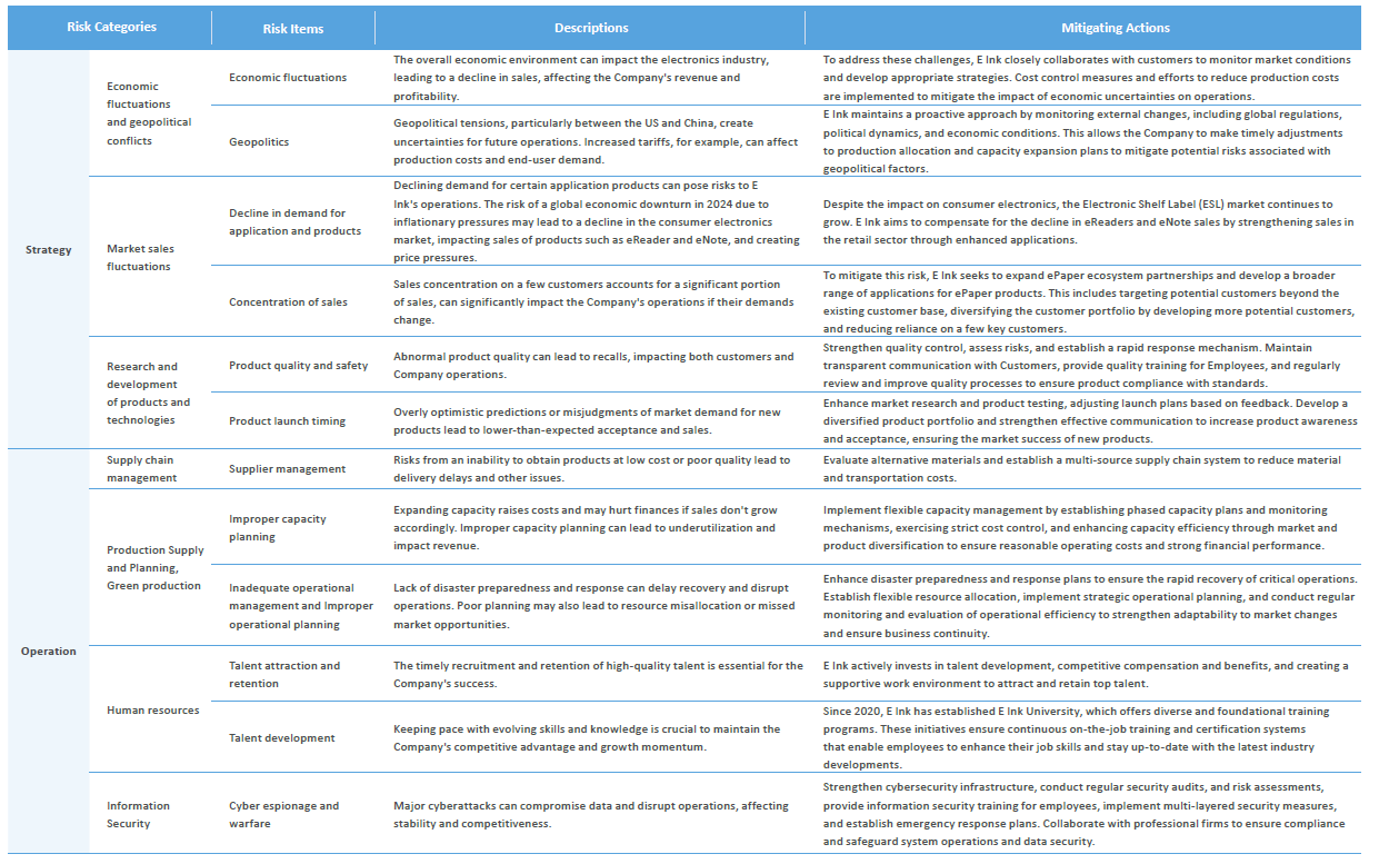

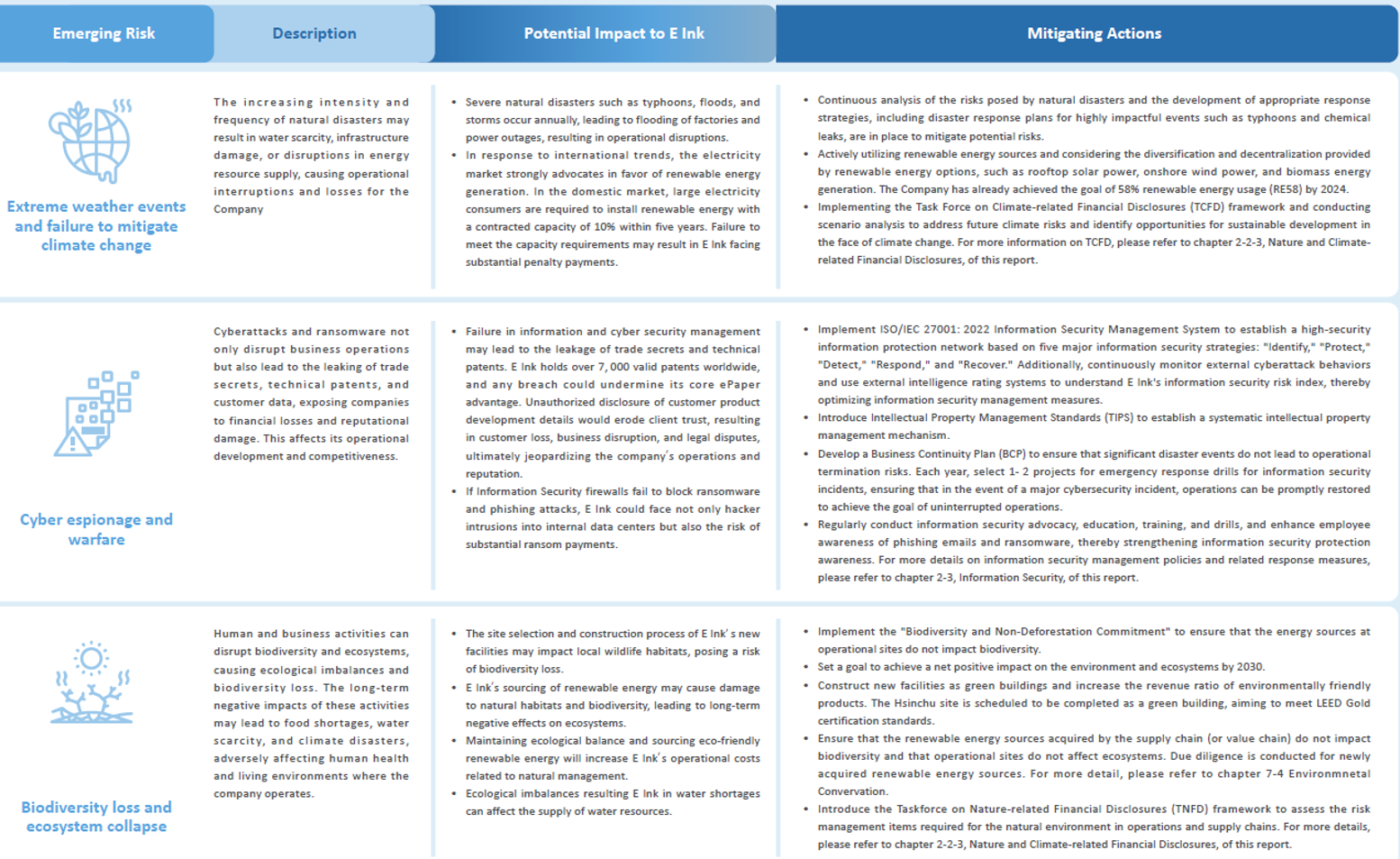

In accordance with the Risk Management Policy and Procedures, E Ink has identified 65 potential risk items, including strategic risks, operational risks, financial risks, information security risks, compliance and integrity risks, and emerging risks. These risks have been comprehensively identified as potentially hindering the Company's goal achievement or causing losses or negative impacts. Although emerging risks currently have no significant impact on operations, potential medium to long-term effects are expected.

E Ink has referred to the World Economic Forum's " 2024 Global Risk Report" and " 2025 Global Risk Report" to identify three emerging risks closely related to its operations.

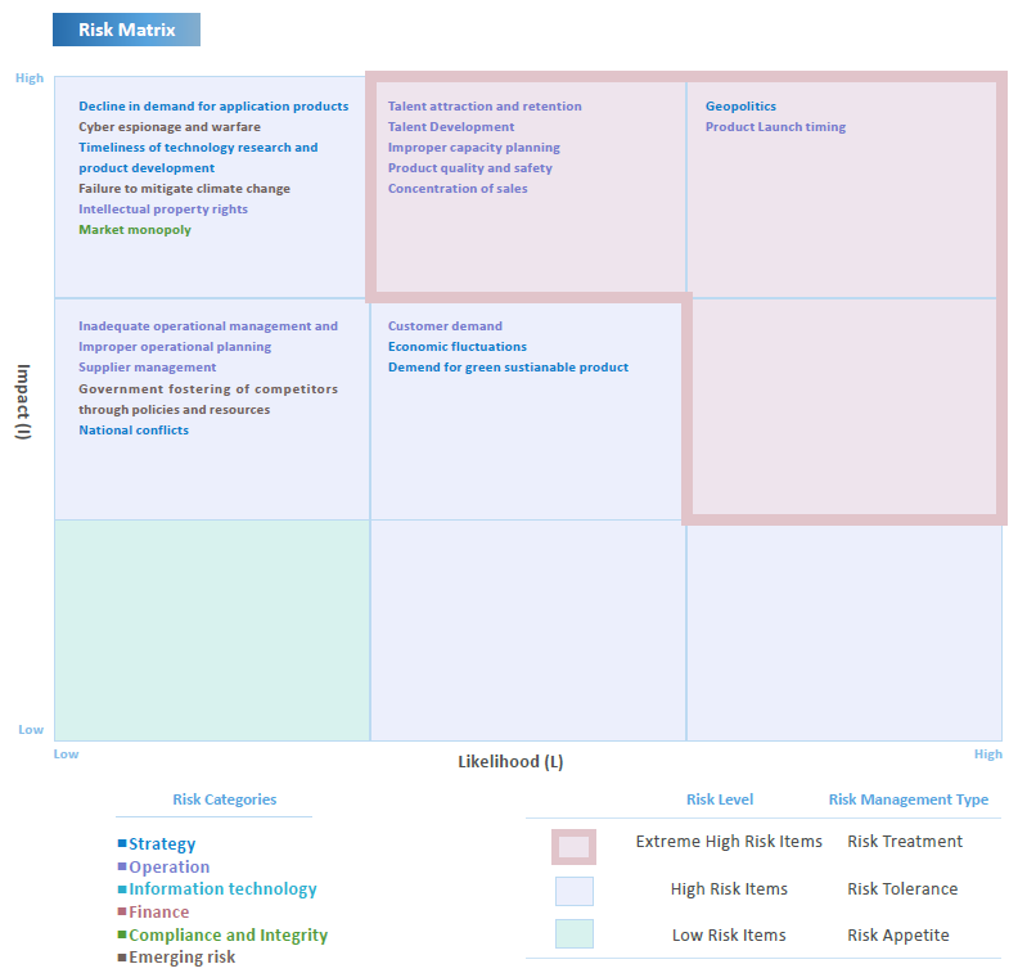

E Ink uses impact (I) and likelihood (L) as risk quantification metrics to identify and review risk exposure. The risk identification survey was completed by the global function center heads and Associate Vice Presidents and above, assessing the risk exposure based on the likelihood and impact of financial, strategic, operational, and other financial and non-financial indicators within their scope of duties. These items were then categorized into three levels of risk with corresponding management measures, including:

• Low Risk Items: These are within the interval of risk appetite, indicating that E Ink is willing to accept these identified risk items. Appropriate management strategies are needed to monitor and maintain risks at this level.

• High Risk Items: These fall within the interval of risk tolerance, necessitating proactive management strategies to ensure risks are controlled within acceptable limits.

• Extreme High Risk Items: These are within the interval of risk treatment, indicating that the risk level extremely exceeds E Ink's risk appetite. This requires necessary mitigating actions with designated responsible functions to conduct risk treatment measures and reduce the risks to a controllable level.

In 2025, a total of 20 significant risk items were identified, including 7 extremely high-risk items and 13 high-risk items. These were further consolidated and classified into 2 major risk themes, strategic and operational, and 7 risk categories for critical risk management. Compared to the risk identification results of 2024, the number of extremely high-risk items decreased from 13 to 7, achieving the target reduction rate for high-risk items. However, due to factors such as economic, industry, and geopolitical changes, as well as the expansion of operational scale, E Ink will continue to control, mitigate, or eliminate risks to enhance risk tolerance and resilience.